Prototype Sustainable Fund

The Fund aims to deliver capital growth over the long term (5 years or more) using our Sustainable Future investment process to invest in companies globally. This process uses a thematic approach to identify key structural growth trends and invest in well run companies whose products and operations capitalise on these transformative changes.

Relevant UN SDGs

The United Nations Sustainable Development Goals (SDGs) are a global framework for action to solve the most urgent needs of society and the environment.

This fund is aligned to:

We have categorised all 17 SDGs into 3 groups.

Group 1

Climate and Planet

Climate & Planet

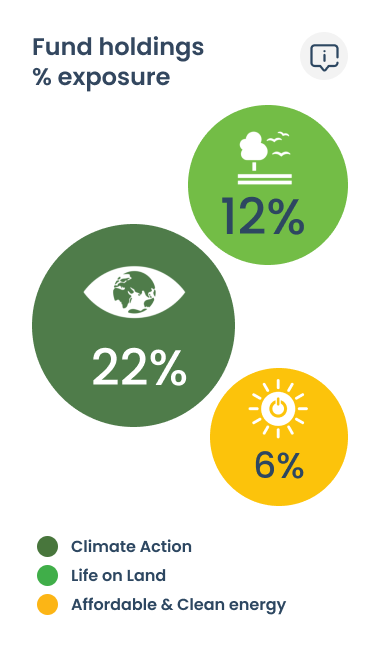

Fund's Exposure to Primary SDGs

This shows the % of the fund which is made up of firms whose revenues are aligned to these SDGs.

Climate & Planet

Engagement is the means by which investors, shareholders and fund managers express opinions and influence companies’ decisions. When you own a share in a company, you own a small part of a business. That means you get certain rights including having a say on how the company's run. You can attend shareholder meetings and vote on management's proposals. Fund managers often have greater stakes in companies. It means they can have a bigger say on a range of issues – from strategy and operational performance, to executive pay. They can also influence companies to adopt better Environmental, Social and Governance practices.

The first Group of SDGs relates to Climate and Planet. The SDGs shown here are those which this fund aligns to, and which fall into the Climate and Planet category.

We define alignment based on what companies do – the products and services they provide – rather than how they behave operationally. We seek to invest in companies which make revenues from specific goods and services that contribute to one or more of the UN’s SDGs.

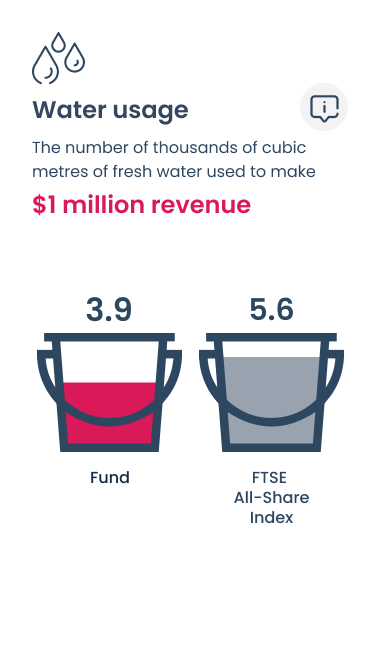

This metric is used to understand and compare water intensity. It measures how many thousands of cubic metres of fresh water are used per $1 million revenue made by the companies held in this fund, and shows its benchmark by way of comparison.

Source: Impact Cubed

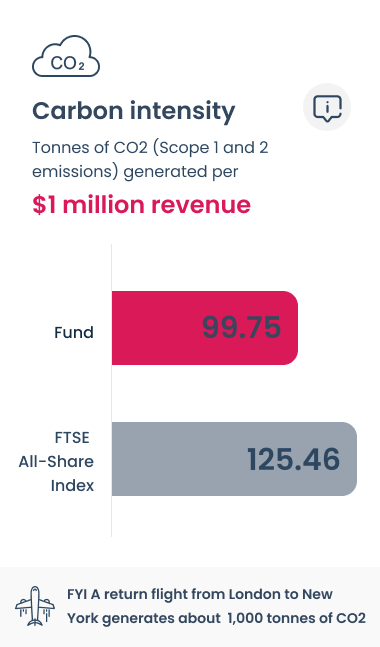

This metric is used to understand and compare carbon intensity. It measures how many tonnes of carbon dioxide are generated per $1 million revenue made by the companies held in this fund, and shows its benchmark by way of comparison.

Source: Impact Cubed

Climate & Planet

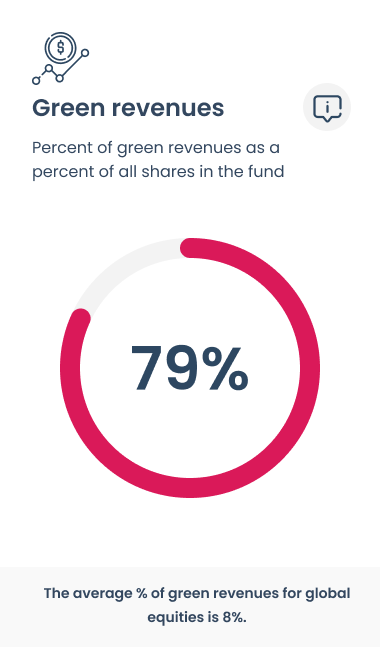

Green revenues

FTSE Russell’s Green Revenues data model measures the green revenue exposure of more than 16,000 securities across 48 developed and emerging markets

Source: FTSE Russell

Group 2

Social Equality

Social Equality

Engagement is the means by which investors, shareholders and fund managers express opinions and influence companies’ decisions. When you own a share in a company, you own a small part of a business. That means you get certain rights including having a say on how the company's run. You can attend shareholder meetings and vote on management's proposals. Fund managers often have greater stakes in companies. It means they can have a bigger say on a range of issues – from strategy and operational performance, to executive pay. They can also influence companies to adopt better Environmental, Social and Governance practices.

The second Group of SDGs relates to Social Equality. The SDGs shown here are those which this fund aligns to, and which fall into the Social Equality category.

We define alignment based on what companies do – the products and services they provide – rather than how they behave operationally. We seek to invest in companies which make revenues from specific goods and services that contribute to one or more of the UN’s SDGs.

Social Equality

Fund's Exposure to Primary SDGs

This shows the % of the fund which is made up of firms whose revenues are aligned to these SDGs.

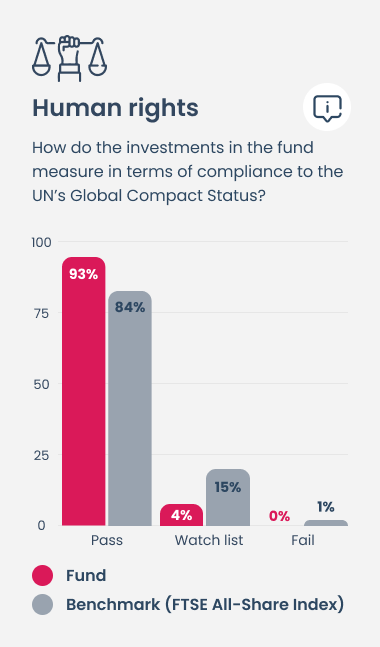

The UN’s Global Compact is the world’s largest corporate sustainability initiative - a call to companies to align strategies and operations with universal principles on human rights, labour, environment and anti-corruption, and take actions that advance societal goals.

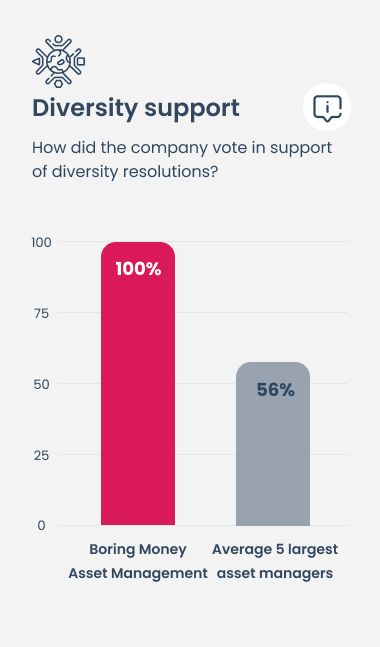

The independent group ShareAction records how fund managers vote. This data is for the 2021 calendar year and shows our track record against the top 5 fund managers by assets in the UK.

Group 3

Economic Sustainability

Economic Sustainability

Fund's Exposure to Primary SDGs

This shows the % of the fund which is made up of firms whose revenues are aligned to these SDGs.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur venenatis egestas erat, sed accumsan massa consequat eu. Etiam finibus enim in sodales lacinia. Donec turpis urna, ultricies id dignissim id, sollicitudin a tortor. Nam eget augue non sem feugiat bibendum nec ut ligula. Duis malesuada diam eu convallis consequat. Nullam odio risus, aliquet sed egestas ut, sagittis eget felis. Lorem ipsum dolor sit amet, consectetur adipiscing elit

The third Group of SDGs relates to Economic Sustainability. The SDGs shown here are those which this fund aligns to, and which fall into the Economic Sustainability category.

We define alignment based on what companies do – the products and services they provide – rather than how they behave operationally. We seek to invest in companies which make revenues from specific goods and services that contribute to one or more of the UN’s SDGs.

Economic Sustainability

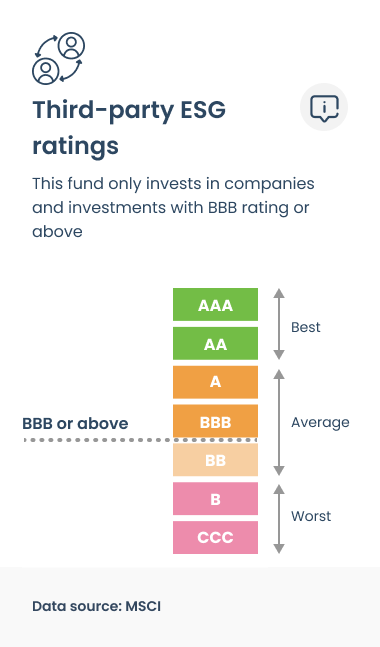

An MSCI ESG Rating is designed to measure a company’s resilience to industry material environmental, social and governance (ESG) risks and opportunities. They use a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and opportunities and how well they manage those risks and opportunities relative to peers.

Example Holdings